The caseworker considers your income and housing costs.Ĭheck the guidance in appendix FM 1.7: financial requirement for more information. You need to show you and your family have enough money to adequately support and accommodate yourselves without relying on public funds.

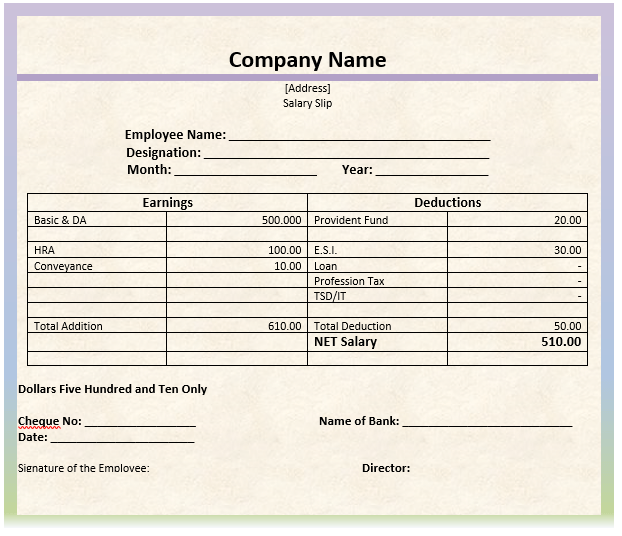

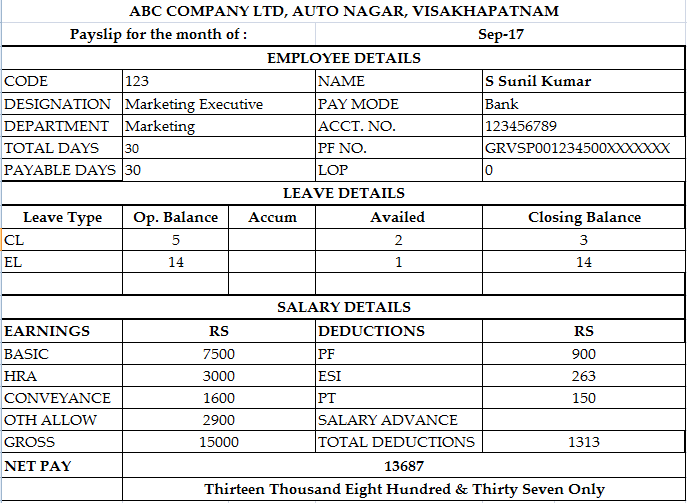

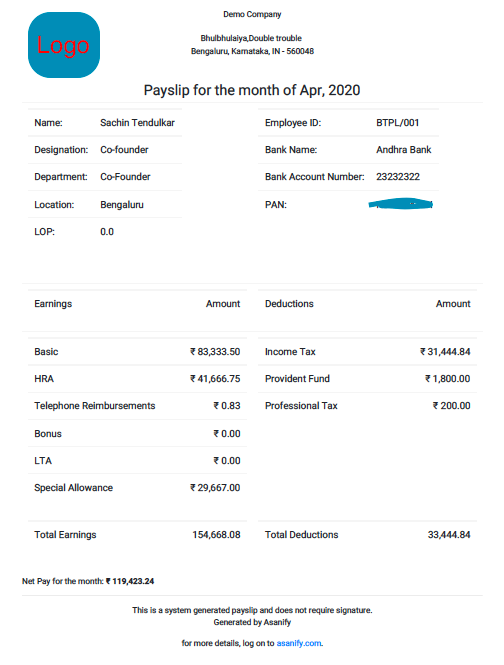

Salary payslip format download#

You may be able to settle in 5 years without meeting the minimum income requirement if either: Download the attached files of Salary Slip in your desired format in Ms Excel or Ms. When you do not need to meet the income requirement If you do not meet the requirement, you may be able to settle in 10 years. You need to show you and your partner meet the minimum income requirement if you want to settle in 5 years as a partner. If you cannot meet the minimum income requirement The detailed guidance also explains the evidence you need to provide for each of the types of income you’re relying on.

you want to settle in the UK (get ‘indefinite leave to remain’) within 5 years.This time you will have to add the Employees name from the Employees List after selecting his particular Paybillcode.You and your partner must have a combined income of at least £18,600 a year if: And the same method will be followed for changing option from Option2 to Option1.

Now go to the New Regime page and click on the 'Initialize Option2 Employees Data' button. First of all, select option2 in Edit Deduction Detail page for all the employees, for whom you want tax processing as per New Regime, on changing from Option1 to Option2, already existing Employees' detail in Income Tax processing page will be deleted. The New Regime Income Tax Processing option is available in Maker-Employee Menu now. The nodal branch of PNB for loans in Panchkula has informed that five of their staff members are reported COVID positive, so employees should not visit the branch for next 20 days atleast and send the request at their branch email id changing Income Tax Option1 to Option2, Pl. The validity of wheat advance for class IV employees has been extended upto.

All DDOs are requested to submit pending GIS bills of class IV employees in treasury.

0 kommentar(er)

0 kommentar(er)